Why 2024 Is The BEST Year to Trade-In Your Annuity

Have you bought an annuity in the last two years?

If you have or haven’t, the time to consider your annuity options is right now. The financial landscape has shifted dramatically, and 2024 presents a unique opportunity to maximize your annuity’s potential.

At Vital Retirement Planners, we want you to know why you should seize this moment immediately and how simple it really is.

Urgent Reasons to Trade-In Your Annuity Now

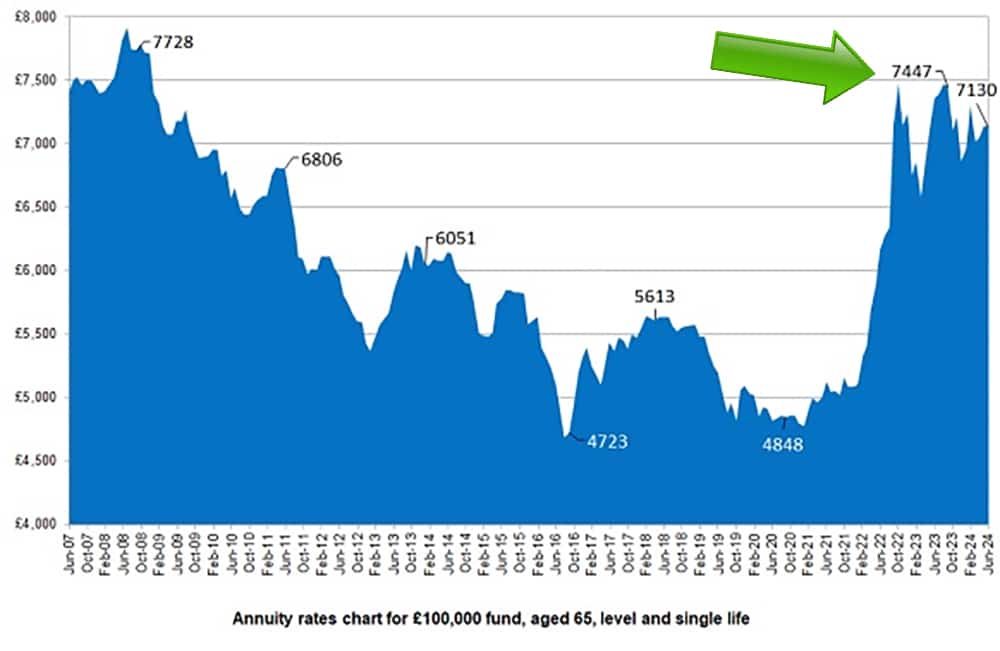

1. Higher Interest Rates: Interest rates have soared to levels not seen in years. This significant rise means that insurance companies can now offer better growth potential and more generous income benefits.

Many annuities purchased in the past couple of years were issued during a period of lower interest rates, severely limiting their growth and payout potential (themoneyadvantage) (fidelity).

2. Enhanced Growth Potential: Trading in your current annuity can unlock better growth potential while safeguarding against market losses.

For instance, some clients who were receiving $30,000 per year in guaranteed income are now eligible for up to $50,000 per year by updating their annuity benefits (themoneyadvantage).

3. Adapt to Changing Financial Objectives: Financial goals evolve over time. Many people originally bought annuities expecting to need the income during retirement. However, with sufficient pensions and Social Security, the income features, which often come with annual charges and lower growth rates, may no longer be necessary.

Trading in for an annuity that better suits your current financial needs can optimize growth and reduce unnecessary fees (annuity).

The Market Is in Your Favor

Just like refinancing debt for better terms, trading in your annuity when interest rates rise can significantly improve your growth potential and provide attractive front-end bonuses (annuity).

The best part – Vital Retirement Planners can help you navigate your trade-in journey so you can get the greatest return with minimal effort.

Immediate Benefits of Trading In Your Annuity

Higher Lifetime Income Payouts: With competing insurance companies vying for your business, the same annuity account value can yield substantially higher guaranteed lifetime income (annuity).

Greater Flexibility and Control: Modern annuities offer features that older contracts may not, such as more flexible payout options and enhanced death benefits. This allows you to tailor your annuity to better fit your retirement strategy and estate planning needs (fidelity).

Strategic Approaches to Annuity Trade-In

Laddering Annuities: Annuity laddering involves purchasing multiple annuities with different terms and payout dates. This strategy mitigates interest rate risk and provides a steady stream of income over time (annuity).

Utilizing Deferred Annuities: Deferred annuities allow your investment to grow tax-deferred until you start receiving income. In a rising interest rate environment, this can significantly increase your annuity’s value before you begin withdrawals (fidelity).

Act Now: Schedule Your Free Annuity Review

The market conditions in 2024 offer a rare window of opportunity to enhance your financial security through an annuity trade-in.

To maximize this opportunity, schedule your free, no-obligation annuity review today.

Our team will help you compare your current annuity with the potential benefits of trading in, ensuring you secure the best possible rates and terms.

Don’t wait – your financial future could depend on it!

Frequently Asked Questions

What are the benefits of trading in my annuity now? Trading in your annuity now can offer better growth potential and higher income payouts due to the current higher interest rates. This can result in more substantial financial benefits compared to older annuities issued during times of lower interest rates.

How do I know if trading in my annuity is the right decision? An annuity review can help you understand the potential benefits of trading in your current annuity. By comparing your current benefits with what you could receive from a new annuity, you can make an informed decision.

What is an annuity ladder strategy? An annuity ladder strategy involves purchasing multiple annuities with different terms and payout dates. This approach can help mitigate interest rate risk and provide a steady stream of income over time.

Act now and review your current annuity to take advantage of the favorable market conditions and enhance your financial security for the future.